The Future of Banking: How Youth Are Shaping The FNB Online Banking Experience

Introduction

The FNB Online Banking Experience

FNB Online Banking Experience; The banking industry has undergone a revolution in recent years, and the rise of online banking has played a significant role in this change. As technology continues to evolve, financial institutions are finding new ways to adapt and stay ahead of the curve. One of the driving forces behind this evolution is the youth, who are embracing online banking in greater numbers than ever before. In particular, FNB Online-Banking has become a preferred banking method for many young people.

In this article, we’ll explore how the youth are shaping the future of banking and how FNB Online Banking is responding to their needs. We’ll take a closer look at some of the innovative features that FNB has introduced to cater to the younger generation’s banking preferences and highlight some of the ways that FNB is staying ahead of the curve. Join us as we explore the future of banking and the role that the youth play in shaping it.

The changing landscape of banking

The world of banking is undergoing a profound transformation, driven by advancements in technology and the changing preferences of the younger generation. Traditional brick-and-mortar banks are no longer the primary choice for today’s youth, who are increasingly turning to online banking options for their financial needs. This shift in consumer behavior has paved the way for innovative financial institutions, like FNB, to revolutionize the banking experience and cater to the digital-savvy generation.

Gone are the days of waiting in long lines at the bank or dealing with cumbersome paperwork. With the rise of smartphones and the internet, banking has become more convenient, accessible, and personalized than ever before. Online banking allows customers to manage their finances from the comfort of their own homes, at any time of the day, with just a few taps on their screens.

The younger generation, in particular, is driving this digital revolution in banking. Born into a world of technology, they are comfortable navigating the digital landscape and expect seamless online experiences in all aspects of their lives, including banking. FNB, recognizing this shift, has embraced the changing needs and preferences of the youth, positioning itself at the forefront of the future of banking.

In this article, we will explore how FNB is shaping the online banking experience to cater to the needs of the youth. From intuitive mobile apps to personalized financial insights, FNB has developed innovative solutions that empower young customers to take control of their finances and make informed decisions.

Join us as we delve into the various features and benefits of FNB’s online banking platform, and discover how the youth are redefining the banking landscape. The future of banking is here, and it’s being shaped by the digital generation.

The rise of digital banking: Convenience and accessibility

In recent years, we have witnessed a significant shift in the way people manage their finances. The rise of digital banking has revolutionized the banking industry, providing unprecedented convenience and accessibility to customers of all ages. However, it is the younger generation that is truly shaping the future of banking through their adoption and utilization of online banking platforms.

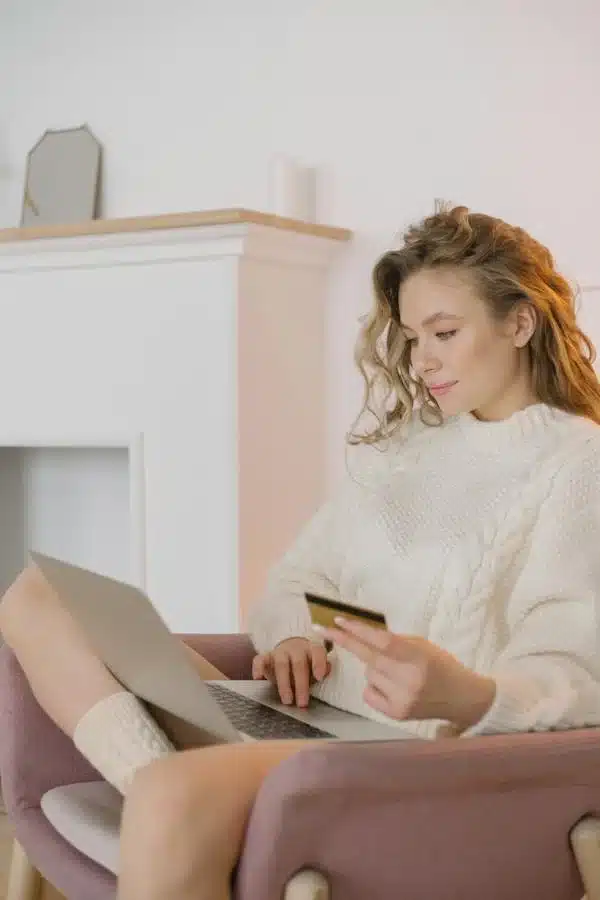

Gone are the days of standing in long queues at brick-and-mortar banks or waiting for paper statements to arrive in the mail. With just a few taps on their smartphones or clicks on their computers, young customers can now access their accounts, transfer funds, pay bills, and even apply for loans, all from the comfort of their own homes or on the go.

The convenience of digital banking cannot be overstated. No longer constrained by traditional banking hours, customers can now manage their finances at any time, day or night. Whether they are traveling, working late, or simply prefer the ease of online transactions, digital banking provides the flexibility that fits into the fast-paced lives of today’s youth.

Accessibility is another key factor that has contributed to the popularity of digital banking among the younger generation. With the widespread availability of affordable smartphones and internet connectivity, accessing online banking services is now within reach for a larger segment of the population. This has empowered young individuals, who may not have had easy access to physical bank branches, to take control of their financial lives and make informed decisions about their money.

Moreover, the rise of digital banking has opened up opportunities for financial inclusion. Traditional banking services can be limited by geographical constraints, leaving many individuals, especially those in remote areas, without access to basic financial services. Online banking has bridged this gap, allowing young people from various backgrounds to participate in the global financial system and enjoy the benefits of digital transactions.

The younger generation’s embrace of digital banking reflects their desire for convenience, efficiency, and autonomy in managing their finances. As technology continues to evolve, we can expect further innovations in the banking sector, driven by the needs and expectations of today’s youth. With their tech-savvy mindset and digital fluency, they are poised to shape the future of banking, ensuring that it remains relevant, accessible, and user-friendly for generations to come.

The role of youth in driving innovation in banking

The banking industry has historically been viewed as conservative and slow to adapt to change. However, with the rise of technology and the increasing influence of the youth, this perception is rapidly changing. The role of youth in driving innovation in banking cannot be overstated.

Today’s youth are the digital natives who have grown up with smartphones, social media, and instant access to information. They have a natural affinity for technology and are quick to embrace new digital solutions. This has led to a fundamental shift in the way banks approach their services, with a strong focus on online and mobile banking.

The youth are not just passive consumers of banking services; they are actively shaping the future of banking through their demands and preferences. Their expectations for seamless and user-friendly digital experiences have forced banks to invest in innovative technologies and user-centric design.

Moreover, the youth are not afraid to challenge traditional banking models and disrupt the status quo. Fintech startups, many founded by young entrepreneurs, are introducing new payment solutions, peer-to-peer lending platforms, and digital wallets that offer greater convenience and accessibility.

In addition to driving technological advancements, the youth are also influencing banks’ social and environmental practices. They are more conscious of the impact their financial decisions have on society and the planet. This has prompted banks to incorporate sustainability and ethical considerations into their products and services, aligning with the values of the younger generation.

The youth’s role in driving innovation in banking goes beyond shaping the user experience. They are also actively participating in co-creation efforts, providing feedback, and collaborating with banks to design and improve their digital platforms. This collaborative approach ensures that the banking services meet the evolving needs and preferences of the youth.

In conclusion, the youth are playing a pivotal role in shaping the future of banking. Their technological fluency, demand for user-friendly experiences, and commitment to social and environmental responsibility are driving banks to innovate and adapt. As the digital landscape continues to evolve, it is clear that the youth will remain at the forefront of transforming the banking industry.

FNB Online Banking: A youth-centric approach

FNB Online Banking has revolutionized the way young people manage their finances, offering a truly youth-centric approach. Recognizing that the younger generation is tech-savvy and prefers convenience, FNB has embraced digital innovation to cater to their needs.

One of the key features that sets FNB Online-Banking apart is its intuitive and user-friendly interface. The platform is designed to be easily navigable, allowing users to effortlessly access their accounts, make transactions, and view their financial information with just a few clicks. This simplicity is particularly appealing to the younger demographic, who value efficiency and ease of use.

Moreover, FNB has prioritized personalization in its online banking experience. By incorporating customizable dashboards, users can tailor their interface to display the information that matters most to them. Whether it’s monitoring their spending, tracking their savings goals, or receiving personalized financial tips, FNB ensures that young customers have the tools they need to manage their finances effectively.

Another aspect that makes FNB Online Banking youth-centric is its integration with popular digital platforms. Recognizing the popularity of social media and messaging apps among young people, FNB has seamlessly integrated features that allow users to send money, make payments, and even check their balances directly through these platforms. This level of integration not only meets the demands of a digitally connected generation but also adds a layer of convenience to their banking experience.

Furthermore, FNB has embraced cutting-edge technologies to enhance security and protect its users’ financial information. Biometric authentication, such as fingerprint or facial recognition, has been implemented to provide secure access to accounts, ensuring that the younger generation can trust FNB with their digital banking needs.

In conclusion, FNB Online-Banking has spearheaded a youth-centric approach to banking by leveraging technology, personalization, and convenience. By understanding the preferences and behaviors of the younger demographic, FNB has created an online banking experience that caters to their unique needs, ultimately shaping the future of banking.

Personalization and customization: Tailoring the banking experience

In the ever-evolving landscape of banking, personalization and customization have become key factors in shaping the future of online banking. As youth play an increasingly prominent role in this digital era, banks are recognizing the need to cater to their unique preferences and demands.

Gone are the days of a one-size-fits-all approach to banking. Today’s youth want a banking experience that aligns with their individual needs and aspirations. They seek personalized features and services that resonate with their lifestyles. This shift in consumer behavior has prompted financial institutions, like FNB, to embrace a more tailored approach.

With the advancement of technology, banks now have the capability to gather vast amounts of data about their customers. By analyzing this data, they can gain valuable insights into customers’ spending habits, financial goals, and preferences. Armed with this information, banks can then personalize the banking experience, offering targeted product recommendations, personalized offers, and tailored financial advice.

For example, FNB’s online banking platform allows users to customize their dashboard, selecting the widgets and tools that are most relevant to them. Whether it’s tracking expenses, setting savings goals, or monitoring investments, customers have the flexibility to design their own banking interface.

Moreover, personalization extends beyond just the digital interface. Banks are exploring innovative ways to connect with customers on a more personal level. This includes personalized communication channels, such as chatbots or virtual assistants, that can assist customers with their specific inquiries and provide real-time support.

The youth of today are not only shaping the future of banking but also driving the demand for personalized and customizable experiences. By tailoring the banking experience to meet the unique needs and preferences of this demographic, FNB and other forward-thinking banks are ensuring they stay relevant and foster long-term relationships with their customers. In this digital age, personalization has become the cornerstone of the future of banking.

User-friendly interfaces and seamless experiences

In the rapidly evolving world of banking, user-friendly interfaces and seamless experiences have become paramount in attracting and retaining the youth demographic. Gone are the days of long queues and tedious paperwork; today’s digital-savvy generation demands a banking experience that is intuitive, efficient, and tailored to their needs.

Leading the charge in this revolution is FNB, whose online banking platform has captured the hearts of young customers across the globe. With a sleek and minimalist design, FNB’s interface embraces simplicity while offering a plethora of features that make banking a breeze. From easy navigation to customizable dashboards, every aspect of the user interface has been carefully crafted to ensure a frictionless experience.

One of the standout features of FNB’s online banking is its seamless integration across devices. Whether accessing their accounts through a desktop, smartphone, or tablet, users can expect a consistent and optimized experience. The responsive design adapts to different screen sizes, ensuring that customers can manage their finances anytime, anywhere, and on any device.

Moreover, FNB’s commitment to user-centric design extends beyond aesthetics. The bank has invested heavily in research and user testing, constantly refining and improving its interface based on customer feedback. This iterative approach ensures that the platform evolves alongside the changing needs and expectations of its young user base.

But it’s not just about the interface; the seamless experience extends to the functionality as well. FNB’s online banking platform offers a wide array of features that cater to the diverse financial needs of its users. From basic transactions like transfers and payments to more advanced services like investment management and loan applications, everything is conveniently accessible within a few clicks.

In conclusion, user-friendly interfaces and seamless experiences are the driving forces shaping the future of banking, particularly when it comes to engaging the youth. FNB’s online banking platform stands as a testament to the power of intuitive design, convenience, and customization. As the banking landscape continues to evolve, it is clear that prioritizing the needs and expectations of customers will remain at the forefront of innovation in the industry.

Embracing technology: Mobile banking and digital payments

In today’s fast-paced world, technology plays a crucial role in shaping the banking industry, particularly when it comes to catering to the needs and preferences of the youth. One significant aspect of this revolution is the rise of mobile banking and digital payments.

Gone are the days when people had to visit physical branches to perform basic banking tasks. With the advent of smartphones and internet connectivity, banking has become more accessible than ever before. The youth, in particular, have embraced this digital transformation, making mobile banking an integral part of their daily lives.

Mobile banking apps offer a wide range of services that enable users to manage their finances on the go. From checking account balances to transferring funds, paying bills, and even applying for loans, everything can now be done conveniently from the palm of your hand. The ease and convenience of mobile banking have revolutionized the way the youth interact with their finances, making traditional brick-and-mortar banking seem outdated.

Digital payments have also gained immense popularity among the youth. With the rise of e-commerce and the increasing acceptance of digital wallets, young individuals are no longer reliant on cash or physical cards to make purchases. Whether it’s shopping online, paying for services, or splitting bills with friends, digital payment options provide a seamless and secure way to conduct transactions, all with just a few taps on a smartphone.

Financial institutions, such as FNB, have recognized the importance of embracing technology and catering to the needs of the youth. By offering user-friendly mobile banking apps, innovative digital payment solutions, and seamless integration with popular platforms like Apple Pay and Google Pay, FNB is revolutionizing the online banking experience for its young customers.

As the future of banking continues to evolve, it is clear that embracing technology, especially mobile banking and digital payments, is crucial. By staying ahead of the curve and providing innovative solutions, financial institutions like FNB are not only meeting the demands of the youth but also shaping the future of banking as a whole.

Enhanced security measures: Protecting customer information

In today’s digital age, where online banking has become increasingly prevalent, the security of customer information has become a top priority for financial institutions. With the ever-evolving landscape of cyber threats, banks are continuously striving to implement enhanced security measures to protect their customers’ sensitive data.

One of the key ways in which youth are shaping the future of online banking is through their demand for robust security features. They are keenly aware of the potential risks associated with digital transactions and expect their banks to have stringent security protocols in place.

To meet these expectations, banks are investing in cutting-edge technologies such as biometric authentication, encryption, and multi-factor authentication. These measures ensure that only authorized individuals can access their accounts and carry out transactions, providing customers with peace of mind.

Moreover, banks are actively engaging with their young customers to educate them about online security best practices. They are promoting the use of strong, unique passwords, advising against sharing sensitive information online, and encouraging regular monitoring of account activity. By empowering their customers with knowledge, banks are fostering a culture of security-conscious individuals who actively take measures to protect their online banking experience.

Additionally, banks are continuously monitoring and analyzing customer behaviors and transactions to detect any suspicious activities promptly. They use advanced fraud detection algorithms and AI-powered systems to identify potential threats and take immediate action to safeguard customer accounts.

The future of banking lies in the hands of the youth, and their emphasis on enhanced security measures is driving banks to innovate and adapt. By staying ahead of the curve and prioritizing the protection of customer information, banks can build trust and ensure that online banking remains a safe and secure experience for all generations to come.

The future of banking: Predictions and trends

The world of banking is constantly evolving, and it is crucial for financial institutions to stay ahead of the curve to meet the changing needs of their customers. As we look towards the future of banking, there are several predictions and trends that are shaping the industry.

One of the key trends is the rise of mobile banking. With the increasing use of smartphones and the convenience they offer, more and more customers are opting for mobile banking services. This trend is especially prevalent among the youth, who are digital natives and prefer carrying out their banking activities on their mobile devices. Mobile banking apps provide a seamless and user-friendly experience, allowing customers to conveniently manage their finances anytime and anywhere.

Another important prediction for the future of banking is the integration of artificial intelligence (AI) and machine learning. These technologies have the potential to revolutionize the way banks operate and interact with customers. AI-powered chatbots and virtual assistants can provide personalized and real-time assistance to customers, answering their queries and helping them with various banking tasks. Machine learning algorithms can also be utilized to analyze vast amounts of data, enabling banks to offer customized financial solutions and detect patterns of fraudulent activities.

Blockchain technology is also expected to have a significant impact on the future of banking. This decentralized and secure method of record-keeping can streamline processes such as cross-border transactions, reducing costs and increasing efficiency. Additionally, blockchain has the potential to enhance security and transparency in banking operations, providing customers with greater trust and confidence in their financial transactions.

Furthermore, the future of banking is likely to see increased collaboration between traditional banks and fintech startups. Fintech companies are often at the forefront of innovation, introducing new technologies and services that cater to specific customer needs. By partnering with fintech startups, traditional banks can leverage their expertise and agility to enhance their own digital offerings and provide customers with a wider range of innovative financial solutions.

In conclusion, the future of banking is set to be driven by mobile banking, AI and machine learning, blockchain technology, and collaboration between traditional banks and fintech startups. By embracing these trends and predictions, banks can adapt to the changing preferences of their customers and deliver a seamless and personalized online banking experience.

The Future of Banking: How Youth Are Shaping The FNB Online Banking Experience

Empowering the next generation of banking customers

In conclusion, the future of banking lies in empowering the next generation of customers. With the rise of technology and the increasing influence of youth, it is clear that traditional banking methods are no longer sufficient to meet their needs. The FNB online banking experience is a prime example of how banks are adapting to cater to this tech-savvy generation.

By providing a seamless and user-friendly online banking platform, FNB has successfully captured the attention and loyalty of young customers. The convenience and accessibility offered by digital banking channels have revolutionized the way people manage their finances.

Furthermore, FNB has embraced the importance of personalization and customization in banking services. By offering tailored solutions and personalized recommendations, they have created a banking experience that resonates with the preferences and needs of the youth.

As we look ahead, it is evident that the influence of youth will continue to shape the future of banking. Their expectations for convenient, tech-driven, and personalized banking experiences will only grow stronger. Therefore, it is crucial for banks to invest in digital transformation, innovative technologies, and customer-centric approaches to stay relevant in the ever-evolving banking landscape.

In conclusion, FNB’s online banking experience serves as a blueprint for other banks to follow. By embracing the needs and preferences of the next generation, they have successfully positioned themselves as a leader in the digital banking space. As the future unfolds, it is essential for banks to adapt and evolve to meet the demands of the youth, ensuring a seamless and empowering banking experience for years to come.

In this article, we explored how youth are shaping the future of banking, specifically the FNB online-banking experience. As technology continues to advance, younger generations are demanding more convenient and accessible banking services. FNB has recognized this need and has been proactive in adapting their online banking platform to cater to the preferences of the youth.

By embracing innovative features, such as mobile banking apps, biometric authentication, and personalized digital experiences, FNB is revolutionizing the way we approach banking. As we look to the future, it is clear that the youth will continue to influence the evolution of online banking, and institutions like FNB are leading the way in providing a seamless and user-friendly experience for their customers.