Artificial Intelligence ETF And Robotics

Best Global Artificial Intelligence etf And Robotics 2022. Welcome to the future! The world is changing rapidly with advancements in technology and Artificial Intelligence (AI) leading the way. As we enter a new year, it’s essential to keep an eye on exciting investment opportunities that will shape our lives for years to come.

The article discusses about the Best Global AI ETF and Robotics of 2022 – Artificial Intelligence etf; A sector that has shown immense growth potential over recent years. From self-driving cars to virtual assistants, AI & robotics are becoming increasingly common in today’s society. So let’s dive into what makes these investments stand out from the rest and why they should be part of your portfolio in 2022.

What is artificial intelligence?

Artificial intelligence (AI) is a growing field of computer science and engineering focused on creating intelligent machines that can reason, learn, and act autonomously. AI research encompasses a wide range of topics, from machine learning and natural language processing to robotics and computer vision.

AI technology is already being used in a variety of applications, including search engines, voice recognition systems, fraud detection, and autonomous vehicles. While there is still much work to be done in AI, the potential benefits are significant. With continued research and development, AI could help us solve some of the world’s most pressing problems, from climate change to healthcare.

What are the benefits of artificial intelligence?

Artificial intelligence can help you automate processes and tasks.

Artificial intelligence can improve your decision-making skills.

Artificial intelligence can help you analyze data more efficiently.

Artificial intelligence can improve your customer service skills.

Artificial intelligence (AI) can be used to process and make decisions on a level that humans are simply not capable of. With the rapid expansion of AI capabilities, the potential benefits are vast and varied.

Here are just a few examples of how AI can be used to improve our lives:

Increased efficiency and productivity: AI can be used to automate repetitive tasks or processes. This frees up time for people to focus on more important tasks or simply enjoy some well-deserved leisure time.

Improved decision making: AI can help us make better decisions by providing accurate and up-to-date information. For example, Google’s self-driving car uses sensors and data gathered from millions of miles of driving to make real-time decisions about route planning, traffic conditions, and more.

Enhanced creativity: As AI gets better at understanding and replicating human behavior, it can also be used to generate new ideas or help us see things from a different perspective. For example, Adobe’s “Adobe Sensei” system is being used to create realistic 3D images and videos – something that would have been impossible without AI technology.

Greater personalization: Perhaps one of the most personal ways we’ll see AI impacting our lives is through greater personalization of products and services. Already we are seeing this with music and video streaming services like Spotify and Netflix using AI to recommend new content.

What are the risks of artificial intelligence?

1. What are the risks of artificial intelligence?

Artificial Intelligence etf; Many experts have raised concerns about the potential risks of artificial intelligence, particularly when it comes to the development of autonomous weapons systems. Other risks that have been highlighted include the possibility of AI being used for mass surveillance and the manipulation of public opinion, as well as the wider impact of AI on jobs and economic inequality.

The risks of artificial intelligence (AI) have been widely discussed and debated. Some experts believe that AI could lead to the development of intelligent machines that could eventually surpass human intelligence, leading to a future where humans are dominated by machines.

Other risks associated with AI include the potential for mass unemployment as machines increasingly replace human workers, and the possibility of AI being used for malicious purposes such as creating autonomous weapons. However, it is important to note that many of the risks associated with AI are speculative and may never come to fruition.

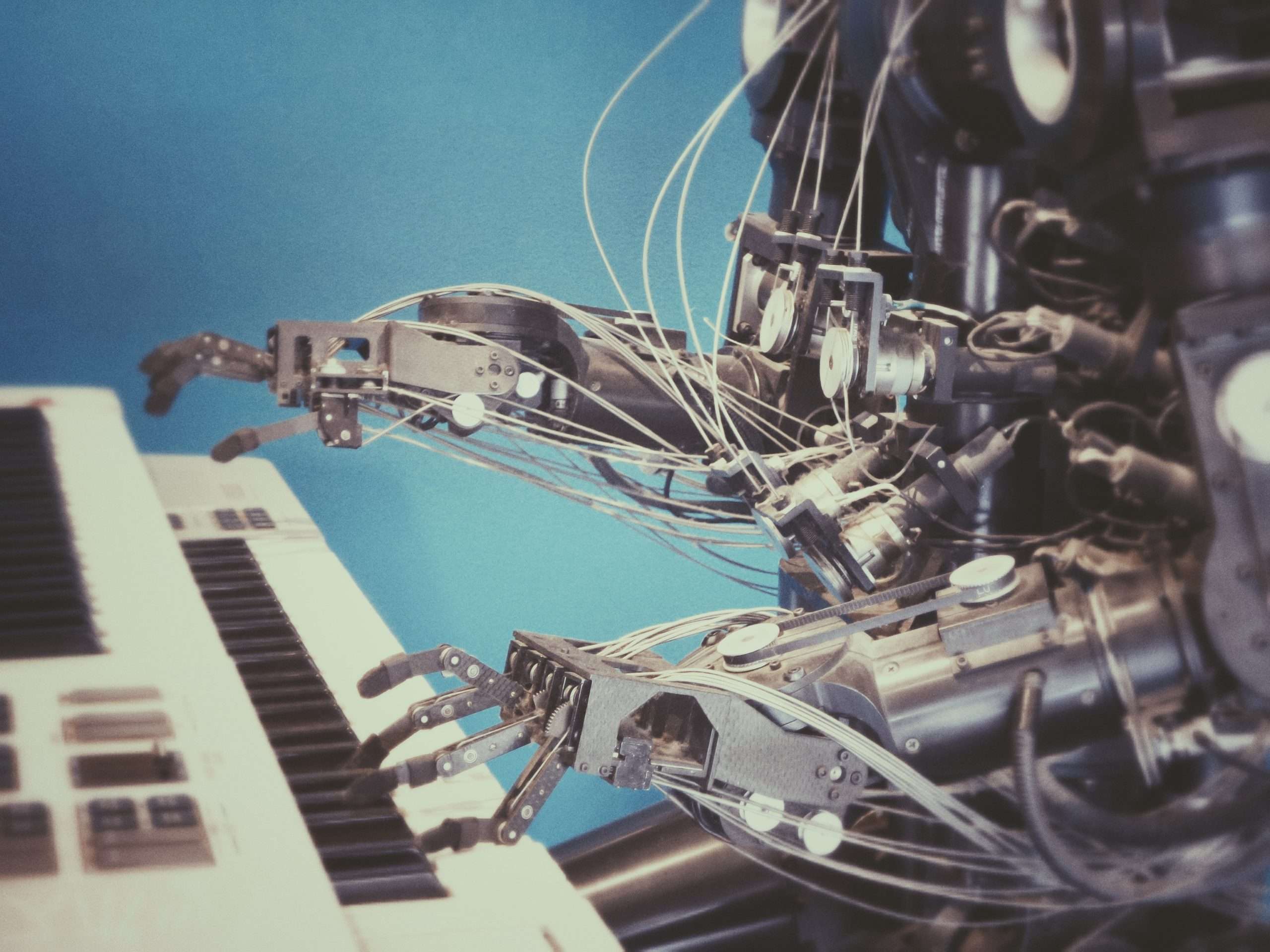

The best global artificial intelligence etf and robotics for 2022

The iShares Global Robotics & Artificial Intelligence Thematic ETF (BOTZ) seeks to track the investment results of companies that are expected to benefit from the increased adoption and utilization of robotics and artificial intelligence (“AI”), including in the areas of manufacturing, healthcare, logistics, and others.

The fund invests in companies across developed and emerging markets that are involved in various aspects of robotics and AI, including manufacturers of robots, developers of software used in robots or AI systems, providers of components used in robots or AI systems, and end users that are adopting robotics or AI solutions.

How to invest in artificial intelligence etf and robotics

If you’re looking to invest in the future of artificial intelligence and robotics, there are a few things you need to know.

Here’s a guide on how to invest in artificial intelligence etf and robotics:

Understand the technology. Artificial intelligence and robotics are still relatively new technologies, so it’s important to do your research and understand how they work before investing. Consider the risks. Like any investment, there are risks involved in investing in artificial intelligence and robotics. Make sure you understand the risks before investing.

Choose the right ETF or mutual fund. There are many different ETFs and mutual funds that focus on artificial intelligence and robotics. Do your research to find one that fits your investment goals and strategy. Start small. If you’re new to investing, or if you’re not comfortable with taking too much risk, start with a small investment in an artificial intelligence or robotics ETF or mutual fund. You can always add more as you get comfortable with the technology and the market.